Overview

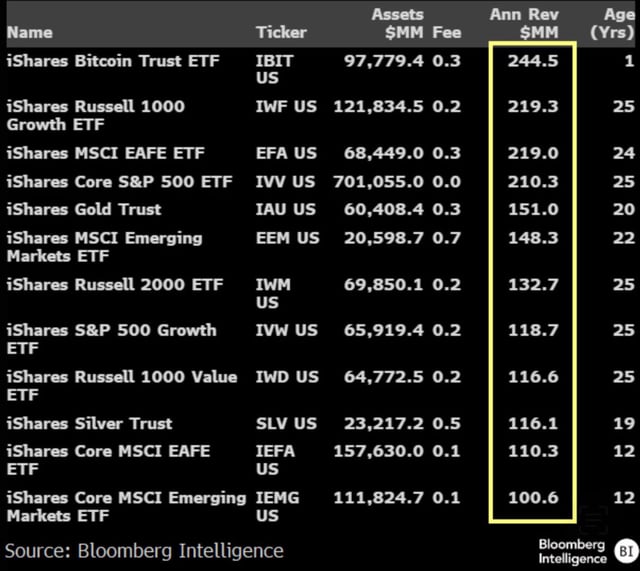

- Market researcher Darkfost, writing as a CryptoQuant author and cited by Bitcoinist, says spot Bitcoin ETFs are drawing growing trading interest.

- Recent ETF volumes are described as commonly reaching $2.5–$5 billion a day, up from a typical $1–$2.5 billion range seen through much of 2024.

- Direct spot trading on exchanges still leads when derivatives are excluded, but the analysis finds ETFs are closing the distance.

- The report highlights that large issuers such as BlackRock and Fidelity now steward sizable ETF-held Bitcoin, which may damp short-term reactivity of that supply.

- ETFs are credited with expanding regulated access for U.S. investors, and the analyst urges close monitoring of ETF inflows and outflows as a market signal.