Overview

- Retirees are encouraged to create free SSA.gov accounts to view personalized benefit projections based on their real earnings history.

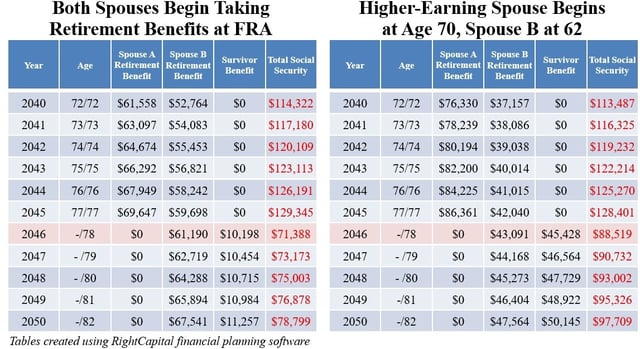

- Waiting past full retirement age up to age 70 boosts monthly payments by 8 percent each year, rewarding those who can defer claiming.

- The One Big Beautiful Bill grants a temporary $6,000 deduction for individuals 65 and older that phases out at $75,000 MAGI for singles and $150,000 for joint filers.

- Spousal benefits and reporting minimal income through part-time work or self-employment can replace zero-earning years and raise the average used in benefit calculations.

- Drawing down retirement accounts or timing IRA and 401(k) withdrawals helps cover expenses during a claim delay and lets retirees capture higher lifetime payouts.