Overview

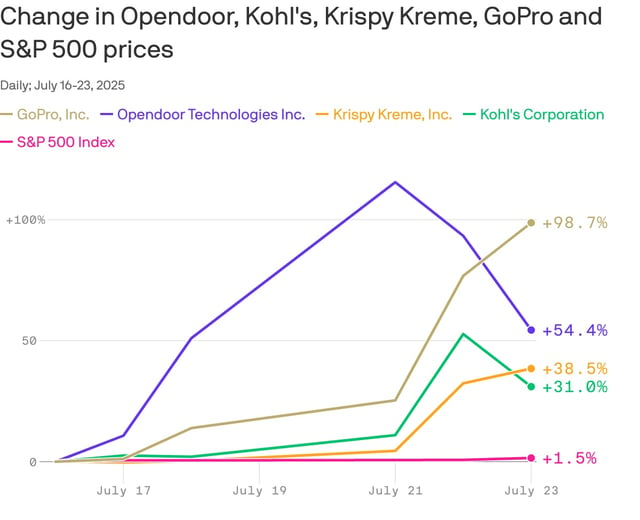

- Retail traders propelled heavily shorted names this week, sending Krispy Kreme up 26.7% on July 22 and 70% in premarket trading on July 23, GoPro to a record one-day gain of 41%, and Beyond Meat up over 20% for the week.

- Benchmark equity indexes and major cryptocurrencies both reached all-time highs, reflecting an elevated risk-on environment across asset classes.

- Trading volumes in short-dated options have spiked and put-to-call imbalances have widened, signaling frothy conditions that could mark the peak of the meme frenzy.

- Large institutional investors have maintained underweight equity positions and largely refrained from joining the retail-driven rallies.

- The latest surge borrows from the early 2021 short-squeeze playbook, but analysts say its impact remains isolated and has yet to unsettle overall market stability.