Overview

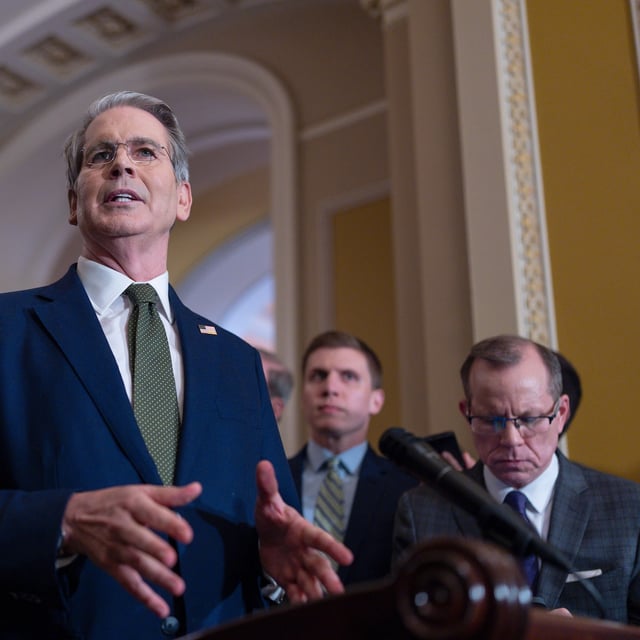

- House Ways and Means Chair Jason Smith and Senate Finance Chair Mike Crapo agreed on June 27 to strip Section 899 after Bessent’s request under the OECD Global Tax Deal.

- Section 899 would have allowed punitive taxes on foreign investors from countries with digital services taxes or OECD Pillar 2 minimum tax rules and was projected to raise $52.2 billion over ten years.

- Bessent said the G7-endorsed agreement will enhance global economic stability and boost U.S. investment, a view echoed by Canada’s Finance Minister François-Philippe Champagne.

- The repeal creates a significant revenue shortfall in the One Big, Beautiful Bill, prompting Republicans to seek alternative offsets and reconsider other funding measures.

- Senate parliamentary rulings against key Medicaid provider tax changes add to the procedural hurdles as lawmakers race to meet the president’s July 4 enactment goal.