Overview

- Treasury Secretary Scott Bessent secured G7 backing to carve U.S. firms out of Pillar 2 levies and requested Congress remove Section 899.

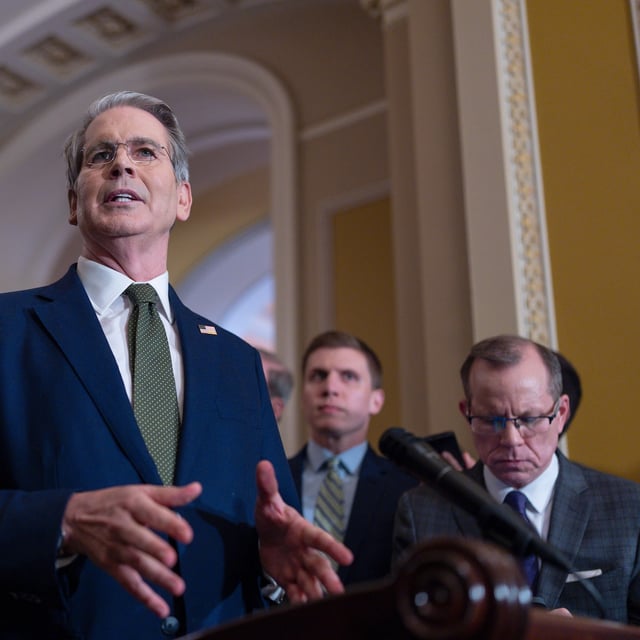

- Senate Finance Chairman Mike Crapo and House Ways and Means Chairman Jason Smith agreed to excise the retaliatory provision and vowed to reimpose it if partners backtrack.

- G7 nations formally endorsed a side-by-side tax framework that cements the exemption and eases transatlantic tensions over digital services and global minimum taxes.

- International business groups and Wall Street applauded the decision, saying it averts investor uncertainty that analysts warned could cost up to 360,000 jobs and $55 billion in GDP annually.

- With the ‘revenge tax’ provision out, Republican leaders are set to advance the One Big Beautiful Bill toward a July 4 passage deadline.