Overview

- The draft circular mandates banks to settle deposit claims within 15 days, charging bank-rate-plus-4% interest on overdue amounts and ₹5,000 per day for delayed locker settlements

- Public feedback is invited now, with the final framework slated to take effect from January 1, 2026

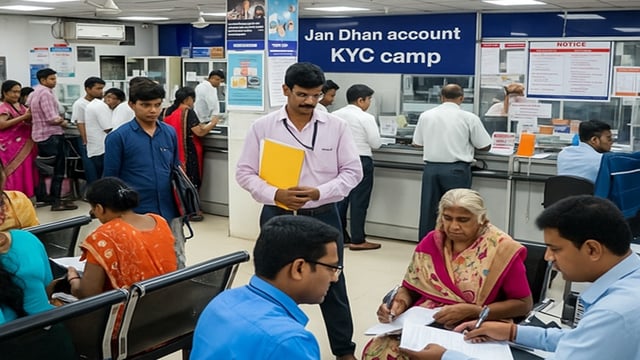

- Doorstep re-KYC camps in nearly 100,000 gram panchayats will continue through September 30, updating over 55 crore Jan Dhan accounts and offering micro-insurance, pensions and grievance redressal

- RBI Retail Direct now supports auto-bidding for Treasury bill SIPs, enabling investors to automate primary auction bids and reinvestments in government securities

- Standardised documentation and processes will replace varied bank-level procedures for nominees and legal heirs, aiming to speed up settlements and reduce hardship for rural customers