Overview

- The Monetary Policy Committee voted unanimously to maintain the repo rate at 5.5% after front-loading 100 basis points of cuts since February.

- The RBI retained a neutral policy stance to allow previous rate reductions to transmit fully into lending and economic activity.

- FY26 growth was kept at 6.5% while the CPI inflation forecast was revised down to 3.1% from 3.7%.

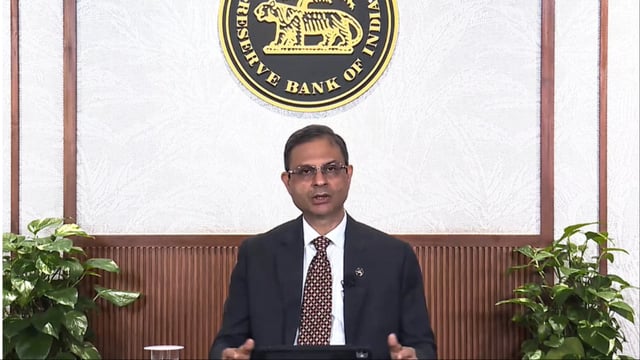

- Governor Sanjay Malhotra highlighted evolving US tariff threats and broader trade uncertainty as key considerations in the decision.

- Headline CPI inflation fell to 2.1% in June, its lowest since early 2019, supported by food price declines following a strong monsoon.