Overview

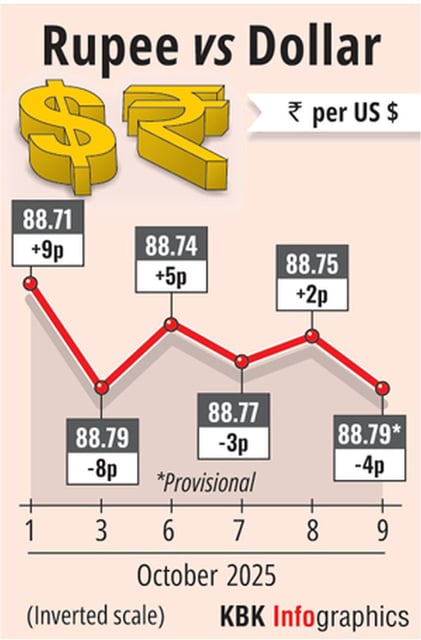

- The rupee closed slightly higher at 88.75 on Oct. 8, up 2 paise for the day and still hovering near its weakest levels.

- One-month non-deliverable forwards signaled a narrow opening band around 88.74–88.76, pointing to tight near-term trading.

- Realised and implied rupee volatility have dropped to multi-month lows, reflecting sustained RBI market smoothing.

- Flows are mixed, with early-week net foreign equity purchases offering some support even as importer dollar demand and weaker Sensex/Nifty weigh.

- External cues include a firm U.S. dollar, Fed minutes suggesting possible rate cuts later this year, and India–U.S. trade talks targeting November that face timing uncertainty from the U.S. government shutdown.