Overview

- The Monetary Policy Committee on June 6 delivered a 50 basis point cut to a 5.5% repo rate and shifted its stance from accommodative to neutral, with a 5-1 vote supporting a larger immediate reduction.

- The RBI also reduced the Cash Reserve Ratio by 100 basis points in four tranches, releasing Rs 2.5 lakh crore of liquidity to bolster banks’ lending capacity.

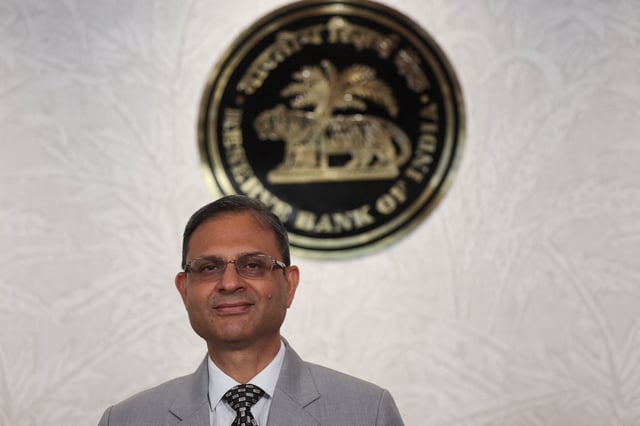

- Governor Sanjay Malhotra cited a decline in retail inflation to 2.82% in May and a projected 3.7% average in FY26 as grounds for front-loading rate cuts to support consumption and investment.

- Deputy Governor Poonam Gupta and other MPC members argued that a single 50 basis point cut would enhance policy certainty and accelerate transmission faster than staggered reductions.

- Banks have already started lowering lending and deposit rates, and the RBI’s neutral stance provides flexibility to adjust policy in response to evolving economic conditions before the next MPC meeting in August.