Overview

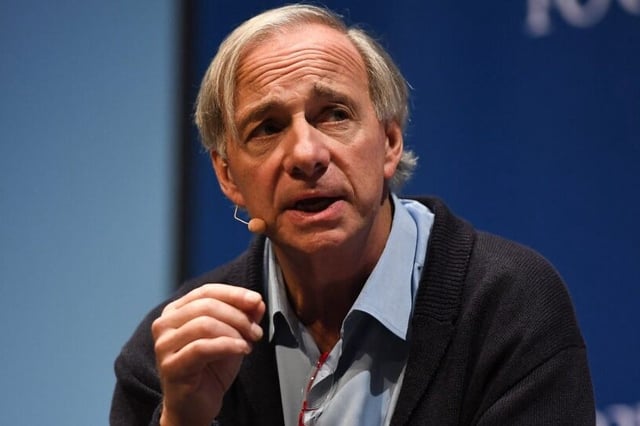

- Ray Dalio, founder of Bridgewater Associates, warns that the U.S. faces an imminent debt crisis due to an unsustainable debt-to-GDP ratio of 122%.

- Dalio emphasizes that the federal government will need to sell more debt than global markets are willing to absorb, creating a severe supply-demand imbalance.

- He suggests reducing the U.S. budget deficit from 7.2% of GDP to 3% through spending cuts, tax adjustments, and interest rate management.

- Experts, including Dalio, express concerns that foreign buyers, once key purchasers of U.S. debt, are now retreating or demanding higher interest rates.

- Dalio predicts 'shocking developments' in how the U.S. may address the crisis, potentially involving debt restructuring, political pressure on buyers, or payment reductions to certain nations.