Overview

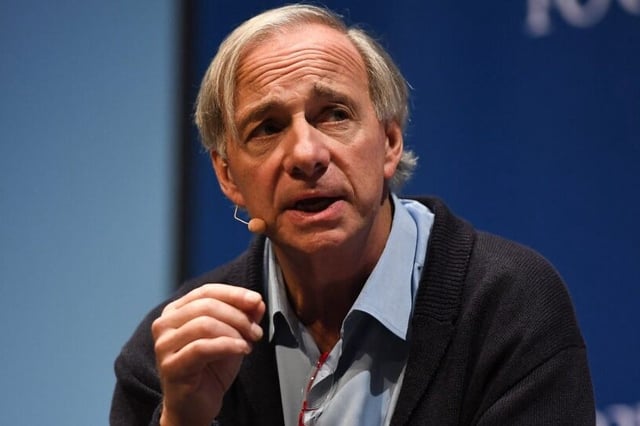

- Ray Dalio has raised concerns about the U.S. federal debt surpassing $36 trillion, with a debt-to-GDP ratio now exceeding 122%.

- Dalio warns that the U.S. faces a supply-demand imbalance, as global buyers may be unwilling to absorb the increasing debt issuance.

- He advocates reducing the federal deficit from its projected 7.2% of GDP to 3% to stabilize the financial system and avoid economic shocks.

- Dalio outlines potential solutions, including debt restructuring, political pressure on foreign buyers, or cutting payments to certain creditor nations.

- Experts echo Dalio's concerns, noting that rising interest payments and diminishing foreign interest in U.S. debt could lead to unsustainable borrowing conditions.