Overview

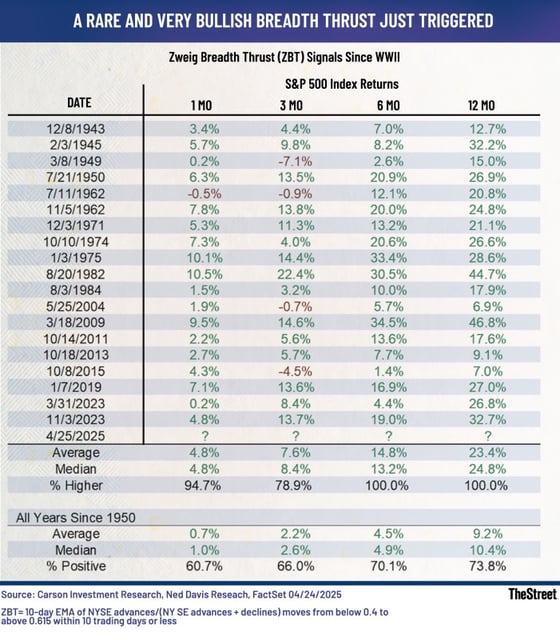

- The Zweig Breadth Thrust, a rare market indicator, was triggered on April 24 after the 10-day EMA of advancing NYSE stocks rose from below 40% to above 61.5% within 10 sessions.

- This marks only the 20th occurrence of the signal since 1945, with all previous instances followed by S&P 500 gains over the next 6 and 12 months, averaging nearly 24% over a year.

- The indicator's activation follows a 19% S&P 500 decline earlier in April, driven by reciprocal tariffs, and a subsequent 10% rally after a 90-day tariff pause announced on April 9.

- Historically, the Zweig Breadth Thrust has correlated with strong short- and intermediate-term returns, averaging 5% after one month and 15% after six months.

- While the signal suggests a positive long-term outlook, analysts caution that interim pullbacks or retests of recent lows remain possible in the short term.