Overview

- Life Insurance Corporation of India fully subscribed to Adani Ports & Special Economic Zone Ltd.’s 15-year, Rs 5,000 crore non-convertible debenture at a 7.75% coupon rate

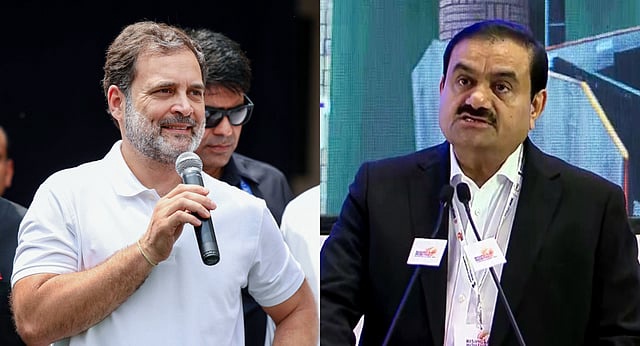

- Rahul Gandhi on June 3 criticised the investment, saying policyholders’ premiums are being diverted to enrich a private conglomerate

- APSEZ reported a 19% year-on-year rise in FY25 EBITDA to Rs 20,471 crore and cut its net debt-to-EBITDA ratio to 1.8x, underpinning its ‘AAA/Stable’ credit rating

- Proceeds are earmarked for a proposed buyback of the company’s US dollar-denominated bonds, pending board approval

- The company plans to use the funds to extend its debt maturity profile and support its target of handling 1 billion tonnes of cargo by FY30