Overview

- PVH Corp. reported Q4 2024 earnings of $3.27 per share, surpassing analyst estimates of $3.21, with revenue of $2.37 billion exceeding the $2.33 billion forecast.

- The company announced a $500 million stock repurchase program as part of its ongoing PVH+ Plan, aimed at driving operational efficiency and brand growth.

- Despite a 5% decline in Q4 revenue, driven by lower sales for Tommy Hilfiger and Calvin Klein, PVH achieved record gross margins and double-digit EBIT margins.

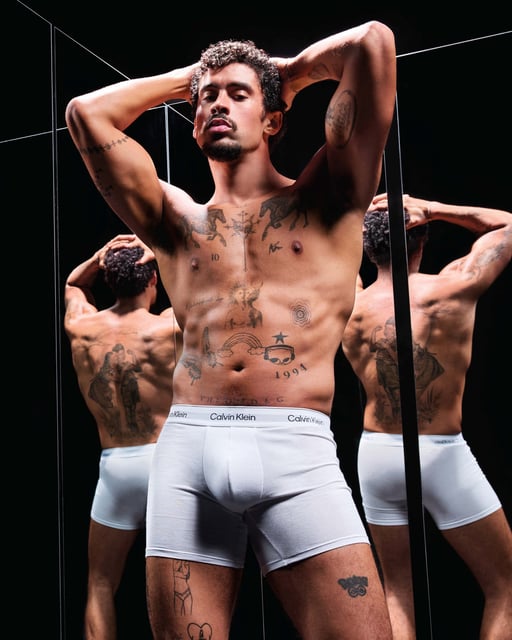

- CEO Stefan Larsson credited the PVH+ Plan and high-profile campaigns, including Calvin Klein’s collaboration with Bad Bunny, for bolstering brand relevance and consumer engagement.

- PVH issued a positive fiscal 2025 outlook, projecting adjusted EPS of $12.40 to $12.75 and flat to slightly increased revenue compared to 2024.