Overview

- PVH Corp. reported adjusted Q4 2024 earnings per share of $3.27 and revenue of $2.37 billion, surpassing analyst expectations despite a 5% year-over-year revenue decline.

- The company provided an optimistic fiscal 2025 outlook, projecting flat to slightly increased revenue and adjusted EPS growth to $12.40-$12.75.

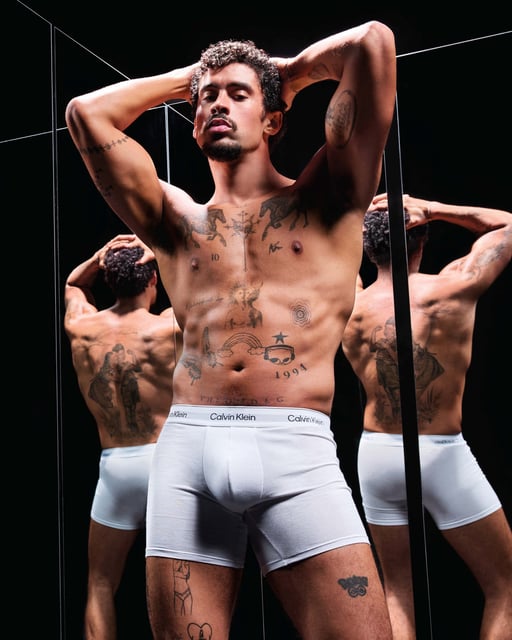

- Shares surged over 12% in after-hours trading, reflecting investor confidence in PVH's PVH+ Plan and brand-building initiatives, including a high-profile Calvin Klein campaign with Bad Bunny.

- PVH announced plans for $500 million in share repurchases in 2025, signaling a commitment to returning value to shareholders.

- The company continues to face regulatory scrutiny in China over Xinjiang-related practices, a developing issue with potential implications for its global operations.