Overview

- Federal Reserve Chair Jerome Powell said equity prices are “fairly highly valued,” prompting a pullback on Wall Street and a softer tone across Asia.

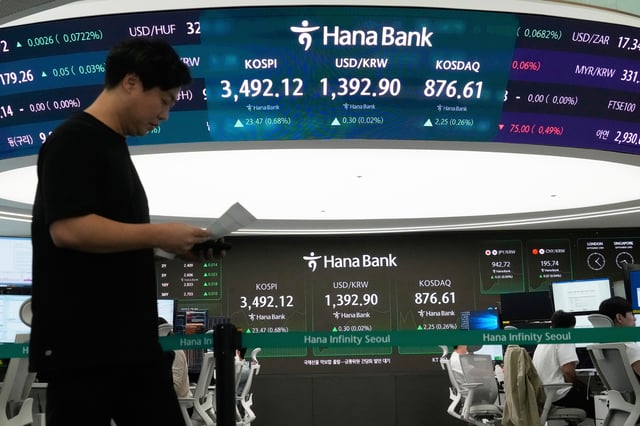

- South Korea’s KOSPI closed down 0.4% at 3,472.14 as foreigners sold a net 251.6 billion won; the won weakened to 1,397.5 per dollar and tech shares were mixed.

- Pakistan’s KSE-100 rose roughly 845 points in early Wednesday trade to around 158,790, touching an intraday high near 159,034 on broad sector gains.

- The early PSX surge tracked expectations for the government to sign a Rs1.225 trillion financing facility with 18 banks to help reduce circular debt in the power sector.

- In Pakistan’s corporate updates, OGDC reported a 19% year-on-year profit decline and declared a Rs5 4Q dividend, taking the full-year payout to a record Rs15.05 per share, while India’s Sensex and Nifty opened lower on continued FII outflows and policy worries.