Overview

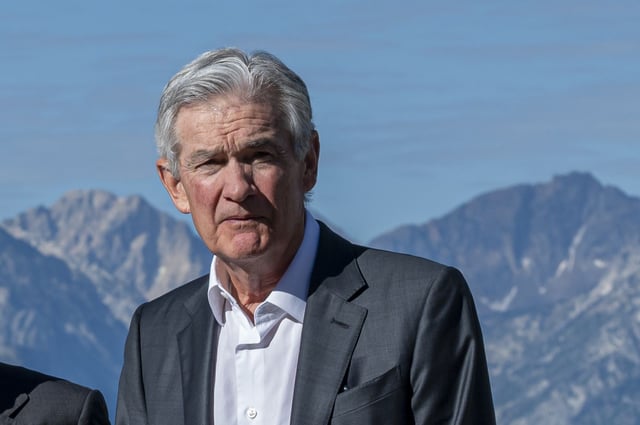

- The Fed chair is slated to speak Friday at 10 a.m. ET in Jackson Hole on “Economic Outlook and Framework Review.”

- Futures imply about an 83% chance of a September cut, down from more than 95% earlier, per CME FedWatch.

- The latest jobs report showed payrolls up just 73,000 with steep downward revisions, leaving the three-month average near 35,000.

- Inflation signals have firmed, with a hotter-than-expected PPI and core consumer inflation above 3% as tariffs begin to pass through to prices.

- Analysts outline three possible messages—signal a cut, stress inflation risks, or stay data-dependent—with Bank of America expecting a more cautious tone while voices like Jeremy Siegel see room for easing.