Overview

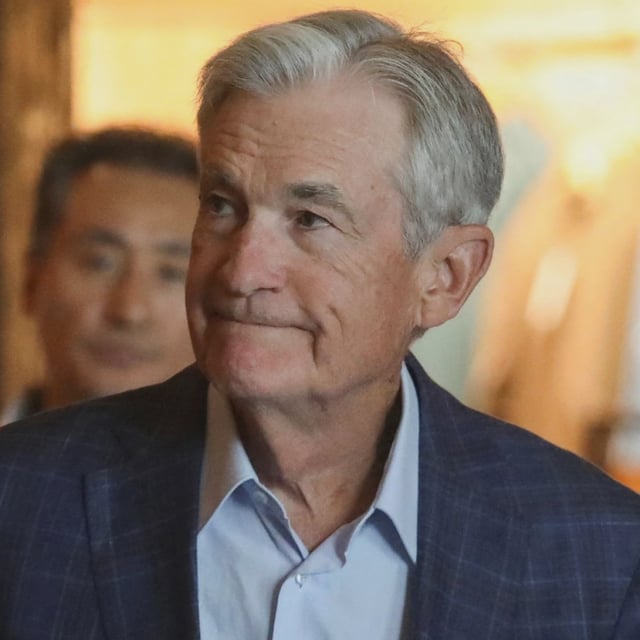

- Futures and money markets assigned roughly 90% odds to a September rate cut after the speech.

- The Dow set a record as the S&P 500 and Nasdaq rose and two‑year Treasury yields fell, alongside a weaker dollar and a stronger euro.

- Powell said the labor market has entered an unusual balance that could deteriorate quickly, which could warrant easing.

- He cautioned that new tariffs are lifting some prices and could foster more persistent inflation, complicating the policy path.

- The policy rate remains at 4.25%–4.50% ahead of the Sept. 16–17 meeting, and Powell underscored Fed independence as Trump’s public pressure and threats toward Governor Lisa Cook continued.