Overview

- Plug Power filed a Sept. 22 prospectus supplement covering the resale of stock tied to more than 185 million March 2025 warrants with a $2.00 exercise price that remain exercisable until March 2028, with legal opinion from Goodwin Procter included.

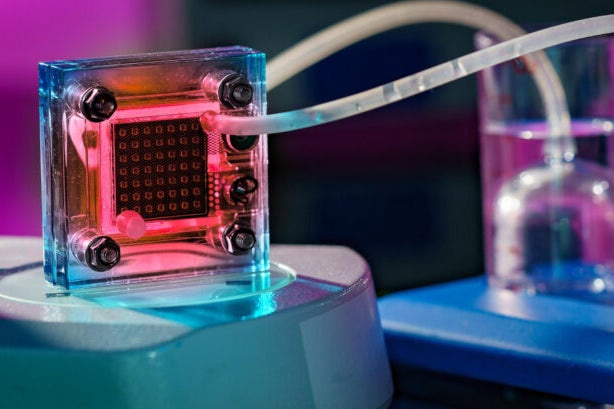

- The company hosted an investor tour of its Georgia green hydrogen plant, reporting a record August with 324 metric tons produced, 97% uptime and 99.7% availability, highlighting its GenEco electrolyzer platform.

- Shares rallied sharply on Monday and rose again premarket Tuesday before reversing intraday, extending a stretch of volatile moves that included a nine‑day advance.

- Coverage frames Plug’s fuel cells and electrolyzers as potential solutions for power‑hungry AI data centers facing grid constraints, a narrative also lifting peers like FuelCell Energy and Bloom Energy.

- Commentary notes the Georgia plant’s output would add modest revenue relative to Plug’s overall sales, the company remains unprofitable, and the newly disclosed warrant mechanics could dilute existing shareholders.