Overview

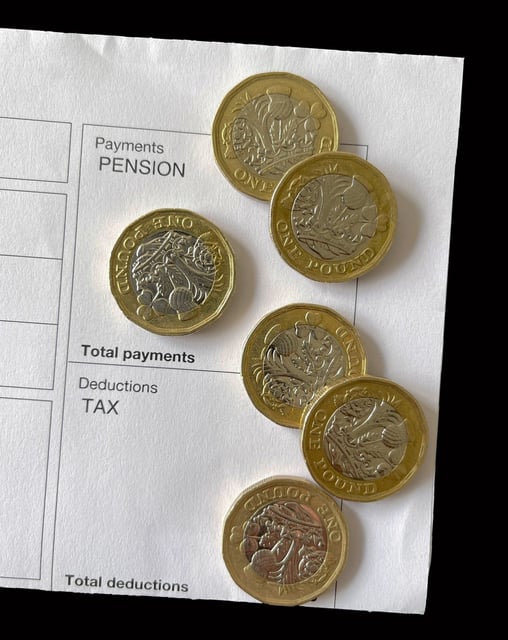

- FCA figures show more than £70bn was withdrawn from pensions in 2024–25, including £18.3bn taken tax‑free, with advisers citing fear of tax changes as a key driver.

- ONS data indicating 4.7% earnings growth points to a similar state pension uprating from April 2026, lifting the full new payment to about £12,535.

- With the personal allowance frozen at £12,570, more retirees are expected to be pulled into income tax next year, and some could face HMRC demands to settle underpayments.

- Ministers have pledged to maintain the triple lock for this Parliament, as industry voices including AJ Bell press for a pensions tax lock to stabilise decision‑making.

- Policy changes already scheduled add pressure: defined contribution pots count toward inheritance tax from April 2027 and the minimum tax‑free access age rises to 57 in 2028, while IFS warns pension‑age shifts risk higher poverty, especially for women.