Overview

- Wedbush raised its price target on PLTR to $160 from $140 and maintained an Outperform rating based on strong AIP adoption.

- Veteran trader Stephen Guilfoyle set a $181 target and described Palantir as a key defense contractor in NATO’s spending plans.

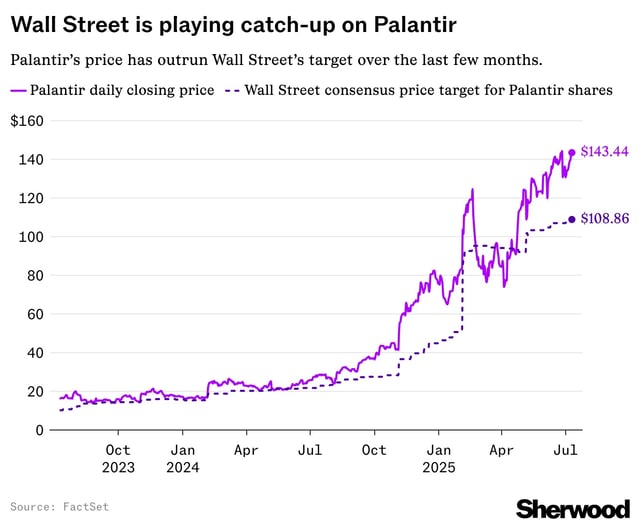

- Palantir closed at $143.13 on July 9, trading near its $144.25 all-time high and up about 90% year-to-date and 403% over the past year.

- The stock trades at a trailing price-to-earnings ratio of roughly 607×, about 14 to 15 times higher than peers such as Salesforce and Microsoft.

- Stanley Druckenmiller and Cathie Wood reduced their Palantir holdings this year amid concerns over its stretched valuation.