Overview

- The offer comprises up to 12.35 million shares in the €62–66 range, with subscriptions due by October 7 and a planned first listing on October 9.

- Gross proceeds are targeted at €766–808 million, including €100 million for Ottobock, with the remainder to the Näder family, who will retain more than 80% ownership.

- Hamburg billionaire Klaus‑Michael Kühne committed up to €125 million in shares, and Capital Group’s Smallcap World Fund plans to subscribe for €115 million.

- BNP Paribas, Deutsche Bank and Goldman Sachs are leading the transaction, which would be the Frankfurt Prime Standard’s first new issuance this year if completed.

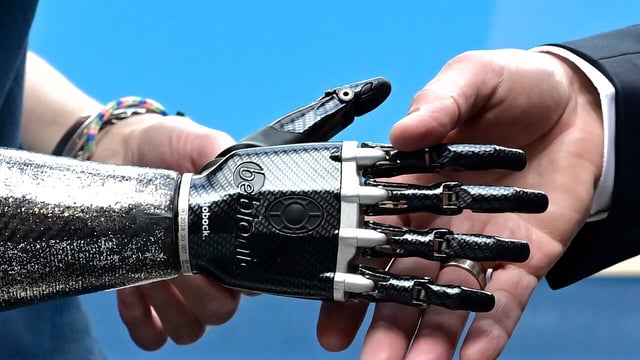

- Management cites investment in Human Bionics and greater financial flexibility as priorities, as the family reduces debt after buying back EQT’s 20% stake; H1 2025 revenue rose 14% to €760 million with adjusted EBITDA at €175 million.