Overview

- The order book was reportedly covered across the full €62–€66 range, including the overallotment option, shortly after the offering opened on Oct. 1, according to a syndicate bank.

- The deal comprises up to 12.35 million shares for gross proceeds of about €766–€808 million, with roughly €100 million in primary capital to Ottobock and the remainder from a secondary sale by the Näder family.

- Trading on the Frankfurt Stock Exchange is targeted for Oct. 9, with subscriptions open to investors through Oct. 7.

- Anchor commitments include up to €125 million from Klaus-Michael Kühne (near 3% stake) and about €115 million from the Smallcap World Fund.

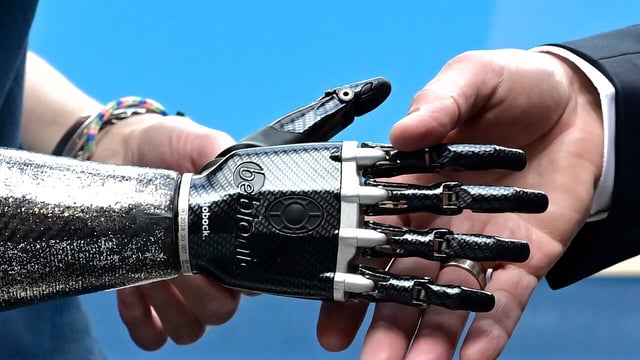

- BNP Paribas, Deutsche Bank and Goldman Sachs lead the syndicate, the Näder family will retain more than 80% ownership, and proceeds support balance-sheet strength and technology investment alongside recent growth (2024 revenue €1.43bn; H1 2025 revenue up 14% to €760m).