Overview

- Oracle is marketing the investment-grade offering in as many as seven parts, including a rare 40-year note guided around 1.65 percentage points over comparable Treasuries.

- Proceeds are earmarked for capital expenditures, future investments or acquisitions, or other general corporate purposes such as debt repayment.

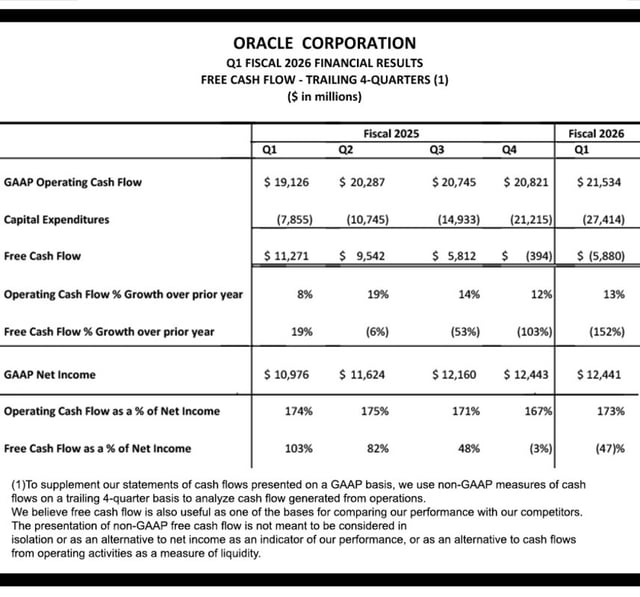

- Free cash flow fell to -$5.9 billion in fiscal Q1 2026 as data center spending rose, with long-term debt around $95 billion at the end of August.

- Credit-default swap costs reached the highest level since May 7, and shares slipped roughly 1.7% after the bond plan surfaced.

- The financing supports major AI infrastructure commitments tied to customers such as OpenAI and reported talks with Meta, and it comes as co-CEOs Clay Magouyrk and Mike Sicilia replace Safra Catz, who becomes executive vice-chair.