Overview

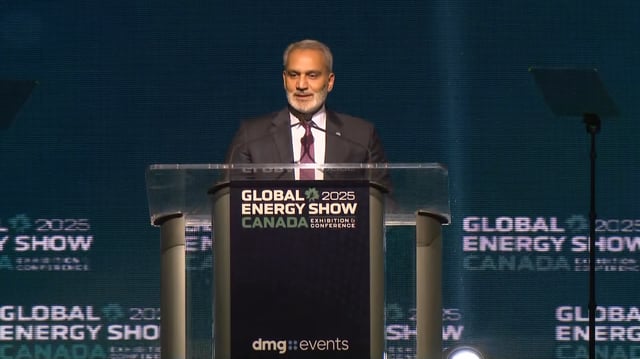

- Haitham al-Ghais said global primary energy demand will surge 44% by 2050, leaving oil as about 30% of the energy mix despite growth in renewables.

- He warned that meeting this demand hinges on timely investment in new oil projects and criticised the IEA’s reversals on investment guidance.

- OPEC+ plans to raise production by 411,000 barrels per day in July, accelerating the unwinding of previous output cuts.

- Research firm S&P Global expects demand growth this year to be the weakest since 2001 and warns an oversupplied market could drive oil prices into the upper US$40 range.

- Al-Ghais dismissed net-zero targets as detached from reality and called for pragmatic policies that leverage carbon capture, renewables and oil to reduce emissions.