Overview

- On July 5, OPEC+ agreed to raise output by 548,000 barrels per day in August, surpassing the 411,000 bpd increases seen over the previous three months.

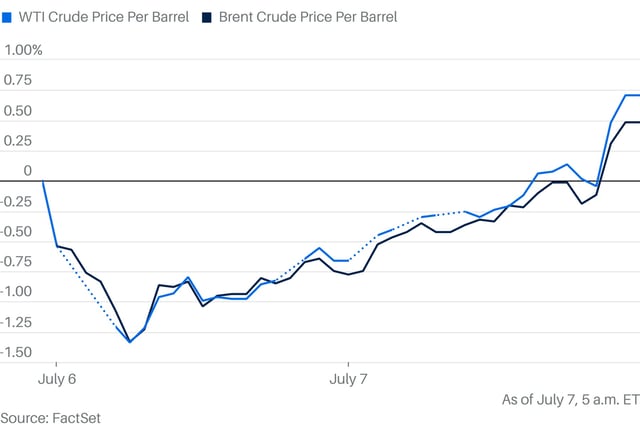

- Brent crude futures hovered near $68 a barrel and U.S. WTI traded around $66 as markets adjusted to the larger-than-expected supply boost.

- RBC Capital analysts estimate the August hike will restore about 80% of voluntary cuts by eight OPEC members, although actual production gains have trailed targets.

- A Wall Street Journal survey of major investment banks finds Brent is forecast to average $66.32 and WTI $63.03 per barrel in 2025.

- Volatility risks are rising on potential U.S. reciprocal tariff reinstatements and Saudi Arabia’s decision to lift August Arab Light prices to a four-month high for Asia.