Overview

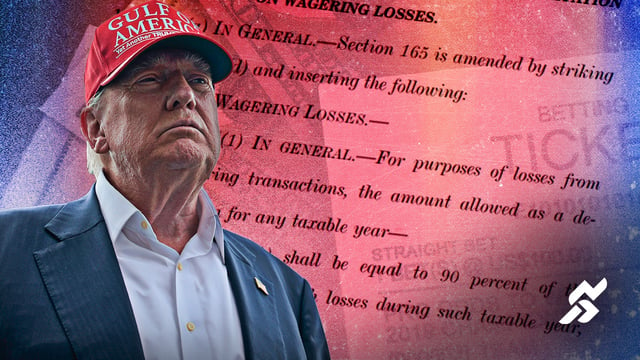

- The One Big Beautiful Bill Act limits gamblers to deduct only 90% of their losses against winnings beginning January 1, 2026.

- The Joint Committee on Taxation projects the deduction cap will raise $1.14 billion in revenue from 2026 through 2034 to support the reconciliation package.

- Professional poker and sports-betting players warn the change could end U.S. pro gambling or drive bettors to unregulated offshore markets.

- The Senate approved the bill 51-50 on July 2 and the House followed with a 219-213 vote on July 3 before sending it to President Trump for his expected signature.

- Industry lobbyists, gaming associations and lawmakers including Rep. Dina Titus are seeking technical corrections or separate repeal legislation before the new rule takes effect.