Overview

- Shares fell about 15% over two sessions after Goldman Sachs launched coverage at Neutral with a $117 price target, citing a full valuation and the need to de‑risk the business model.

- Regulatory filings show CEO Jacob DeWitte transferred roughly $3 million in shares as a gift, director Michael Klein sold about $6.7 million, and CFO Craig Bealmear sold around $9.4 million, according to Verity data.

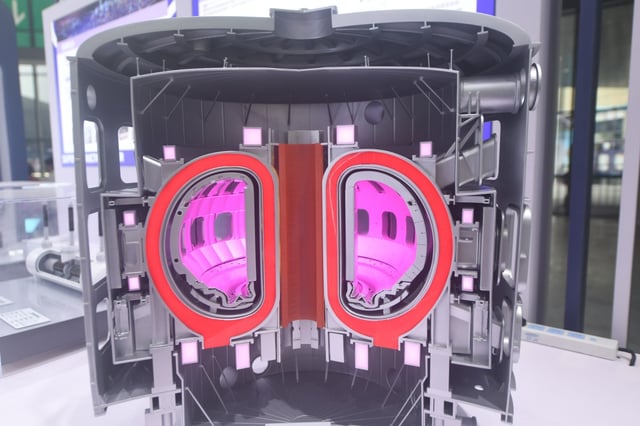

- Oklo said it completed full‑scale prototype fuel‑assembly testing at the Department of Energy’s Argonne National Laboratory through the GAIN voucher program, producing benchmark data to refine models and guide manufacturing.

- The company previously broke ground on its first Aurora reactor at Idaho National Laboratory and expects to file its Nuclear Regulatory Commission licensing application this year.

- Oklo remains pre‑revenue without finalized power purchase agreements and targets initial operations in late 2027 or early 2028, while pursuing a Tennessee facility to recycle used nuclear fuel for fast reactors.