Overview

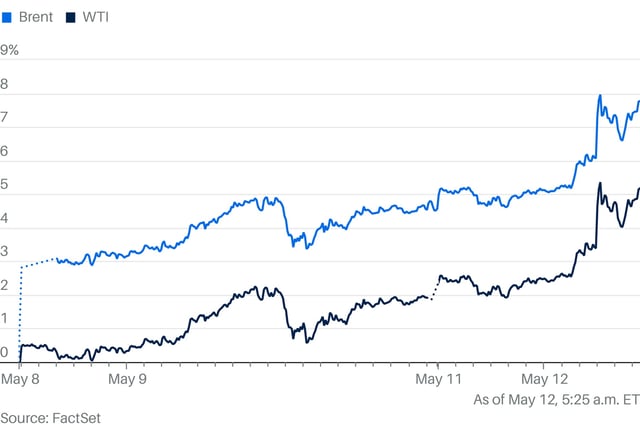

- The U.S. and China agreed to a 90-day suspension of steep tariffs, briefly lifting oil prices to two-week highs before a subsequent pullback.

- Brent crude futures rose to $65.46 per barrel and WTI to $62.49 before easing as markets assessed the potential for a lasting trade resolution.

- OPEC+ has increased oil output more than expected, with further supply hikes scheduled for May and June, potentially capping price gains.

- Saudi Arabia’s crude shipments to China are set to remain steady in June after reaching a one-year high, highlighting stable demand from the region.

- Reduced refining capacity in the U.S. and Europe continues to tighten fuel markets, increasing vulnerability to price spikes during supply disruptions.