Overview

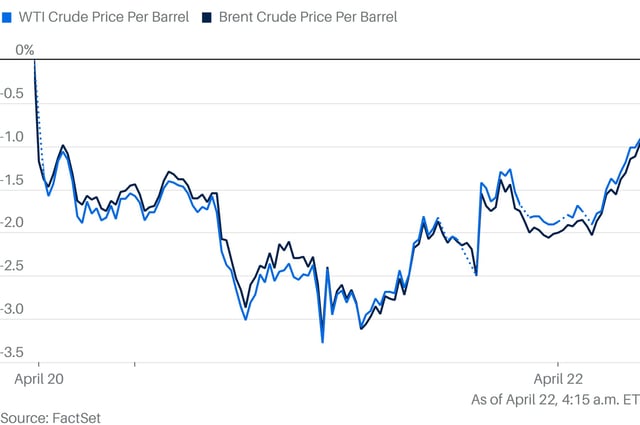

- Oil prices rebounded slightly on April 22 as traders covered short positions after a steep sell-off the previous day.

- Signs of progress in U.S.-Iran nuclear negotiations have raised the possibility of Iranian crude returning to global markets, adding supply pressure.

- OPEC+ plans to increase production by 411,000 barrels per day starting in May, which continues to weigh on market sentiment.

- Economic concerns linked to U.S. trade tariffs and President Trump's criticism of the Federal Reserve have fueled fears of weaker oil demand.

- Market analysts expect ongoing volatility as traders assess geopolitical developments, tariff impacts, and upcoming economic indicators.