Overview

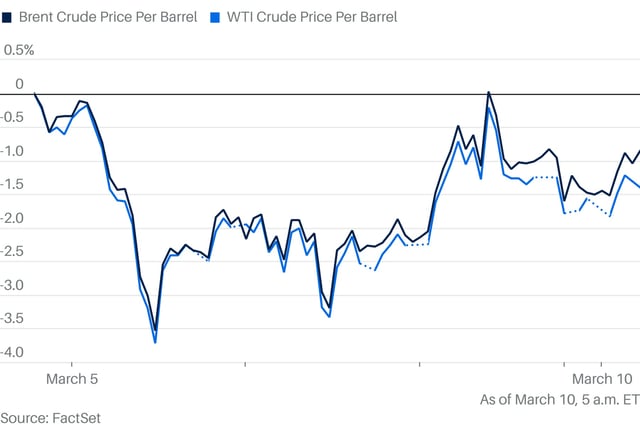

- Brent crude fell 0.4% to $70.11 per barrel, while West Texas Intermediate (WTI) dropped 0.4% to $66.76, marking WTI's seventh consecutive weekly loss.

- U.S. President Donald Trump's tariff policies on Canada, Mexico, and China have raised fears of a global economic slowdown, dampening fuel demand.

- OPEC+ producers, including Russia and Saudi Arabia, plan to increase oil output starting in April, adding further pressure on prices.

- The U.S. is weighing the potential easing of energy sanctions on Russia if it agrees to end its war with Ukraine, while also threatening increased sanctions if no ceasefire is reached.

- Iran has rejected U.S. calls for negotiations over its nuclear program as Trump intensifies efforts to cut Iranian oil exports through sanctions.