Overview

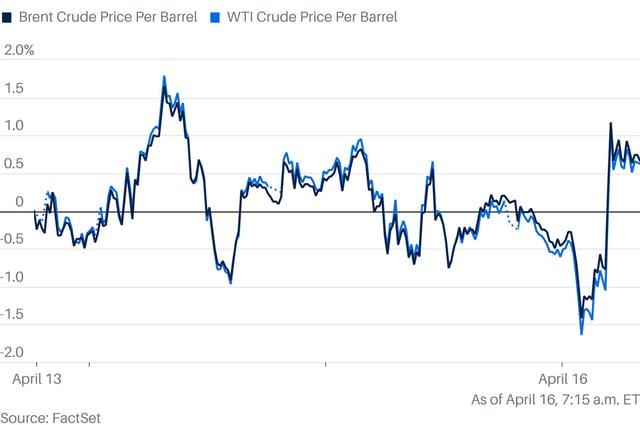

- Oil prices remain subdued, with Brent crude at $65.31 per barrel and WTI at $61.95, reflecting a 13% decline this month due to trade tensions and oversupply concerns.

- JPMorgan and the International Energy Agency have sharply lowered their oil price and demand growth forecasts for 2025, citing weaker global economic conditions and trade war impacts.

- The Trump administration is unlikely to intervene to support oil prices unless they fall by an additional 20%, potentially dropping WTI to $50 per barrel.

- Speculation about potential U.S.-China trade talks briefly boosted market sentiment, though analysts caution that macroeconomic headwinds remain significant.

- OPEC+ production increases and rising U.S. crude inventories are further contributing to the supply-demand imbalance, keeping downward pressure on prices.