Overview

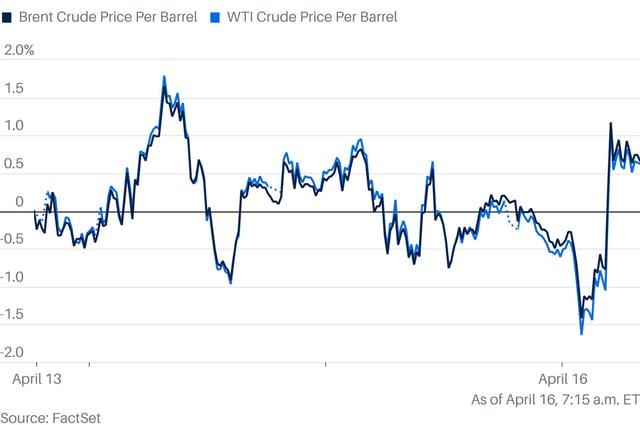

- West Texas Intermediate (WTI) crude is trading at approximately $61 per barrel, and Brent crude at $65, marking their lowest levels in four years.

- The Trump administration is pursuing a strategy to keep oil prices low, with intervention unlikely unless prices drop to around $50 per barrel.

- Rising U.S. tariffs and retaliatory measures, particularly in the U.S.-China trade war, are suppressing global oil demand and contributing to market instability.

- The International Energy Agency forecasts the slowest global oil demand growth in five years for 2025, citing trade uncertainties and economic pressures.

- Analysts, including those from JPMorgan, predict WTI prices could fall below $60 by August and end the year near $55, potentially impacting U.S. shale production.