Overview

- Oil prices initially surged on geopolitical tensions between Israel and Iran but have since moderated due to easing fears of escalation.

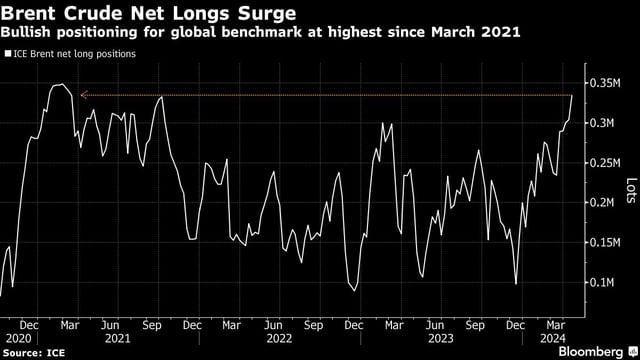

- U.S. and Brent crude futures experienced fluctuations, reflecting the transient impact of Middle East tensions on global oil markets.

- Analysts highlight that without actual supply disruptions, geopolitical risk premiums are unlikely to sustain long-term price increases.

- Investor focus shifts back to market fundamentals, with upcoming U.S. economic data and inflation concerns likely influencing oil prices.

- The market remains cautious, with potential volatility due to ongoing geopolitical risks and adjustments in global oil supply dynamics.