Overview

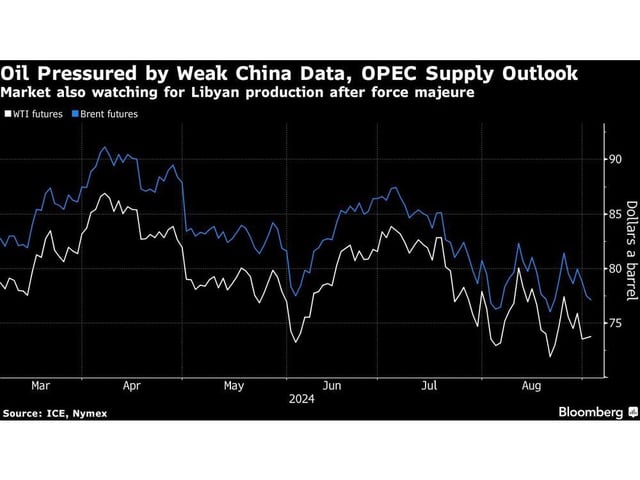

- U.S. crude oil prices have nearly erased all gains for 2024, with West Texas Intermediate trading at $72.45 per barrel.

- China's manufacturing sector contracted to a six-month low, exacerbating demand concerns for the world's second-largest oil importer.

- Libya's force majeure at the El-Feel oilfield has cut production significantly, yet its impact on global prices remains limited.

- OPEC+ is set to increase production by 180,000 barrels per day in October, despite weak demand signals from key markets.

- Economic headwinds in China and the U.S. are contributing to volatility and downward pressure on oil prices.