Overview

- The OECD has called on the UK government to revalue council tax bands based on up-to-date property prices as part of a broader revenue-raising strategy.

- Council tax bands still reflect April 1991 valuations that were rushed and relied on quick estate-agent assessments, leaving hundreds of thousands of homes potentially misclassified.

- Local authorities increased the typical Band D bill by 5% in April to £2,280—with some councils granted hikes up to 10%—exacerbating household cost pressures.

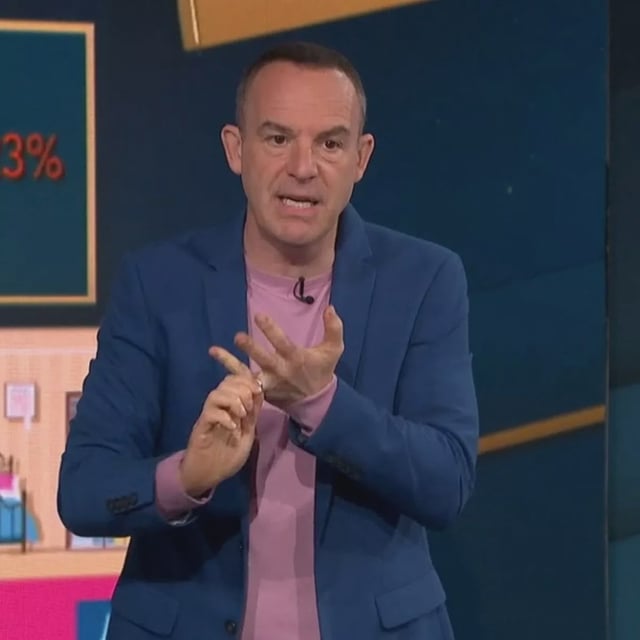

- Martin Lewis advises recent movers to compare their band with neighbouring properties and use online valuation tools before the six-month challenge deadline to secure possible refunds.

- Pressure is mounting on Sir Keir Starmer’s government to overhaul the council tax system to stop unfair overpayments and unlock billions in uncollected revenue.