Overview

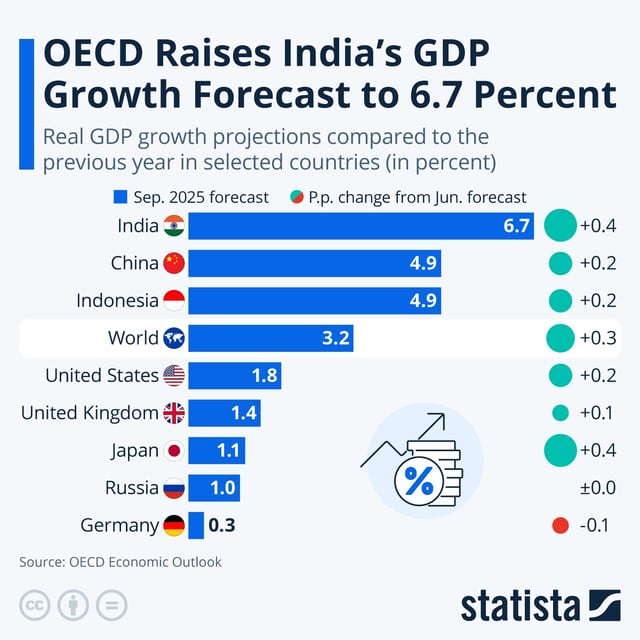

- The OECD raised its FY26 India growth forecast to 6.7%, crediting GST reforms along with monetary and fiscal easing.

- S&P Global Ratings maintained a 6.5% projection for FY26, citing resilient domestic demand supported by a benign monsoon, tax reductions and rising government investment.

- S&P trimmed its inflation view to about 3.2% for the year and expects a 25 basis-point policy rate cut by the Reserve Bank of India.

- External risks persist, with S&P warning that higher US import tariffs and softer global trade have hit India harder than previously assumed.

- Recent momentum included 7.8% GDP growth in the April–June quarter, and sovereign rating upgrades by S&P and R&I pointed to stronger fiscal credibility.