Overview

- A net 18% of firms expected better conditions in Q3, down from 22% previously, with the seasonally adjusted measure at 15% versus 26%.

- Capacity utilisation slipped to 89.1% from 89.4%, pointing to softer operating activity.

- Price pressures strengthened as a net 11% of firms reported raising prices, reversing a net 1% price reduction in the prior quarter.

- Firms cut back sharply on staffing and capex, with a net 23% reducing headcount and more planning to trim spending on plant, machinery and buildings.

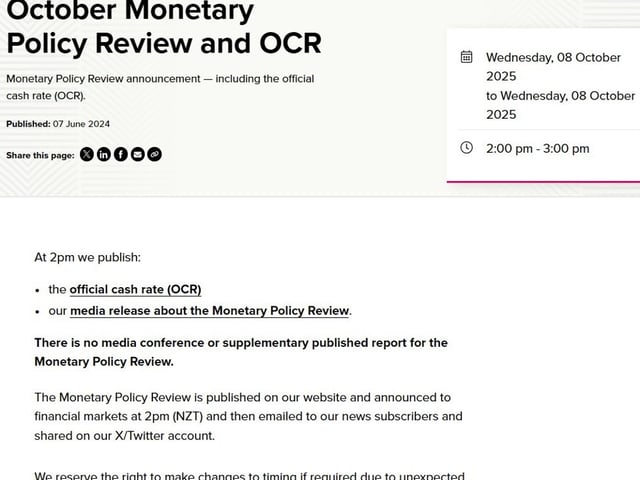

- The survey supports further easing at the Oct. 8 RBNZ meeting, with a Reuters poll centering on a 25 bp cut and some economists expecting 50 bp, as NZIER says nothing in the data would preclude a larger move.