Overview

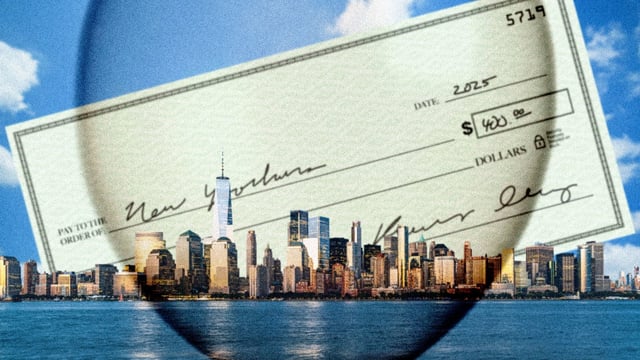

- The $2 billion inflation refund program will provide direct payments to over 8 million New York residents, targeting households under specific income thresholds.

- Refunds are tiered: joint filers earning up to $150,000 will receive $400, while single filers earning up to $75,000 will receive $200, with smaller payments for higher income brackets within eligibility limits.

- Payments will be automatically mailed based on 2023 state tax returns, requiring no additional action from recipients.

- The initiative, funded by pandemic-driven sales tax surpluses, is part of New York’s broader affordability measures, including expanded child tax credits of up to $1,000 per child under four.

- Although the exact mailing date is undetermined, officials anticipate checks to be distributed this fall, marking the first program of its kind in the state.