Overview

- Nvidia shares have climbed about 66% since early April lows, lifting its market cap to roughly $3.8 trillion and briefly overtaking Microsoft and Apple.

- In Q1 fiscal 2026, revenue rose 69% year-over-year and non-GAAP earnings per share climbed to $0.81, underscoring strong AI chip demand.

- U.S. export controls now require licences for Nvidia’s H20 AI processors bound for China, effectively halting sales without a grace period.

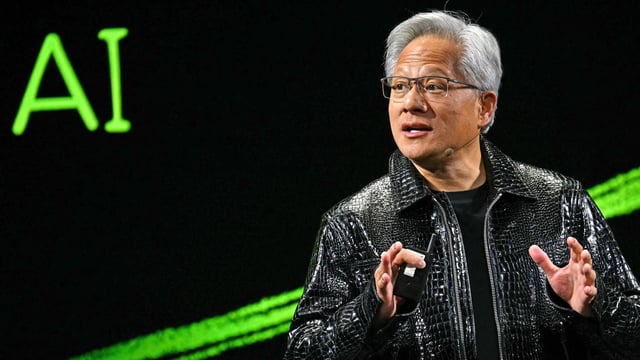

- At its June shareholder meeting, CEO Jensen Huang identified robotics and autonomous vehicles as the company’s next multitrillion-dollar growth engine.

- Loop Capital and Wedbush analysts have boosted Nvidia’s price targets toward $250 and forecast a $4 trillion market cap this summer with the potential to hit $5 trillion within 18 months.