Overview

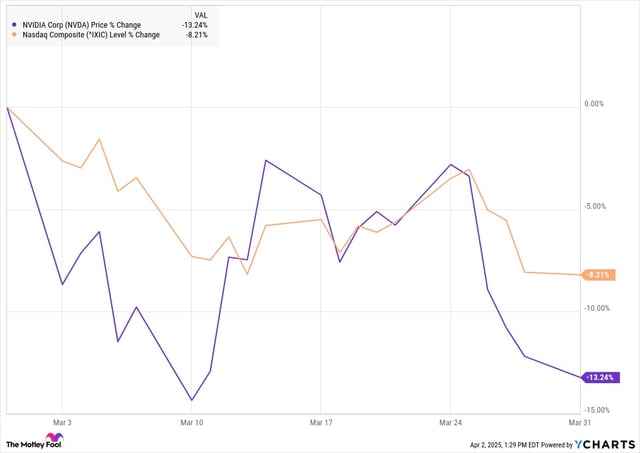

- Nvidia's stock fell 7% on April 3, 2025, following an HSBC downgrade and market reaction to President Trump's new tariffs.

- HSBC downgraded Nvidia from 'Buy' to 'Hold,' cutting its price target from $175 to $120, citing weaker GPU pricing power and slowing revenue growth.

- The bank noted no significant price increases between Nvidia's B200 and B300 GPUs, raising concerns over the company's ability to sustain premium pricing.

- While semiconductors are exempt from the newly announced tariffs, Nvidia's reliance on Asia-Pacific foundries like TSMC highlights ongoing supply chain vulnerabilities.

- Analysts remain divided on Nvidia's long-term prospects, balancing optimism about AI-driven GPU demand with concerns over market saturation and geopolitical risks.