Overview

- Nvidia’s shares have climbed 45% since April lows, adding about $1 trillion to its market value and lifting its valuation to roughly $3.4 trillion—just behind Microsoft.

- The Commerce Department’s mid-May repeal of the AI diffusion rule removed limits on high-end chip exports to key markets.

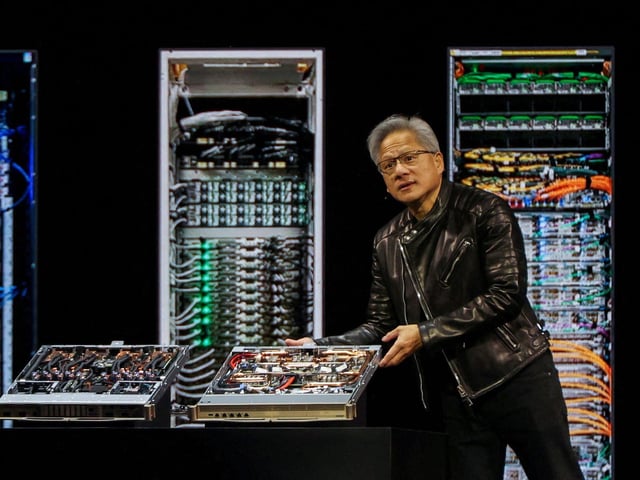

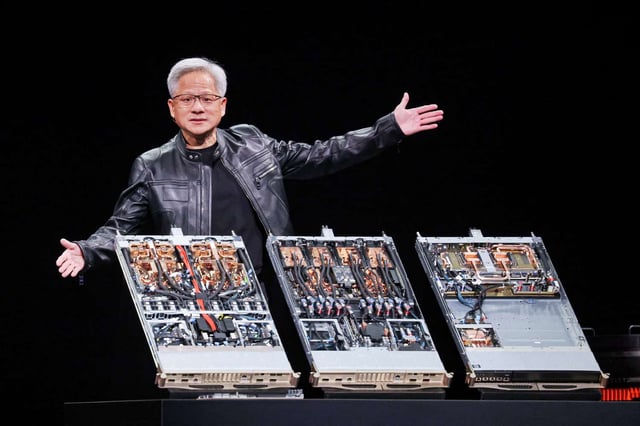

- First-quarter earnings topped projections, easing investor concerns over U.S. export restrictions and confirming strong demand for Blackwell AI chips.

- Microsoft, Meta, Alphabet and Amazon plan roughly $330 billion in AI-related capital expenditures in 2026, underpinning sustained demand for Nvidia’s GPUs.

- Nvidia’s price-to-earnings-growth ratio sits below 0.9, the lowest among the Magnificent Seven, reflecting a comparatively attractive valuation against projected growth.