Overview

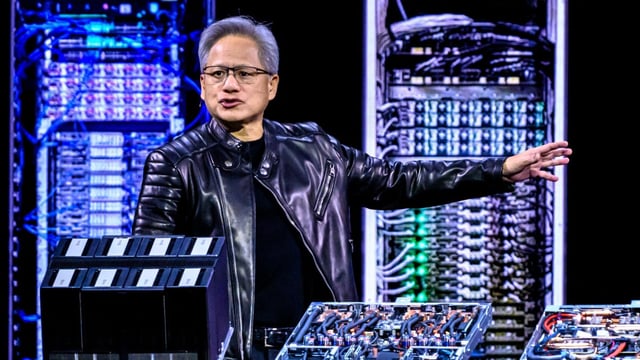

- Consensus forecasts call for about $46 billion in revenue and roughly $1.01–$1.02 in adjusted EPS when Nvidia reports after the bell on Wednesday.

- Options markets imply an approximately 6% share move in either direction, or about a $260 billion swing in market value, following the results.

- Nvidia previously warned U.S. curbs on its China‑focused H20 chip could cut second‑quarter sales by about $8 billion and recorded a $4.5 billion inventory charge in the prior quarter.

- A new deal to pay the U.S. government 15% of China sales restored a path to exports, though analysts expect little to no H20 contribution to Q2 and flag Beijing’s security scrutiny and supplier pauses as ongoing risks.

- Blackwell/GB200 remains the key growth driver, with Nvidia having cited $27 billion in sales and about 70% of data‑center revenue, while Wall Street focuses on third‑quarter guidance near $53 billion and potential margin effects from China shipments.