Overview

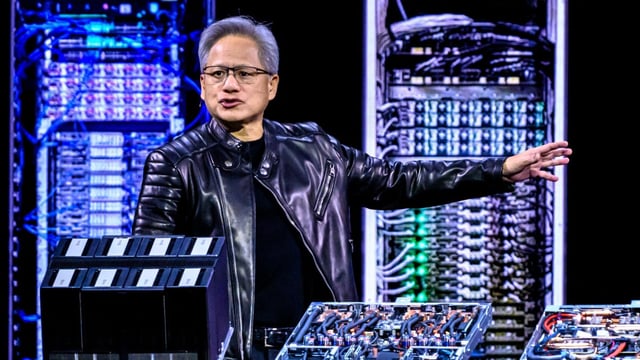

- Nvidia reports after the bell on Aug. 27 with consensus near $46.45 billion in revenue and about $1.02 in adjusted EPS.

- Analysts remain broadly bullish with most targets above $200, and the stock is up roughly a third this year after recently topping a $4 trillion market value.

- U.S. export curbs on the H20 chip threatened about $8 billion in sales, and a reported 15% revenue-sharing deal to resume some China shipments arrived too late to affect Q2 but could shape guidance.

- Some on Wall Street caution that excluding China from guidance could trim estimates by $2–3 billion as investors look for clarity on licensing and demand in the region.

- Nvidia’s Blackwell platform has become the core growth engine—about $27 billion in sales and roughly 70% of data center revenue—so shipment cadence and supply constraints remain key watch items.