Overview

- Shares climbed to an all-time high near $164 as unprecedented demand for its AI GPUs drove the rally

- First-quarter revenue surged 69% year-on-year to $44.1 billion, and Nvidia projects roughly $45 billion in sales for Q2

- The stock has rebounded about 74% since early April after President Trump’s tariff threats and concerns over China’s DeepSeek model

- With a 7.3% weighting on the S&P 500, Nvidia’s market value now exceeds the combined Canadian and Mexican exchanges and all U.K. listed firms

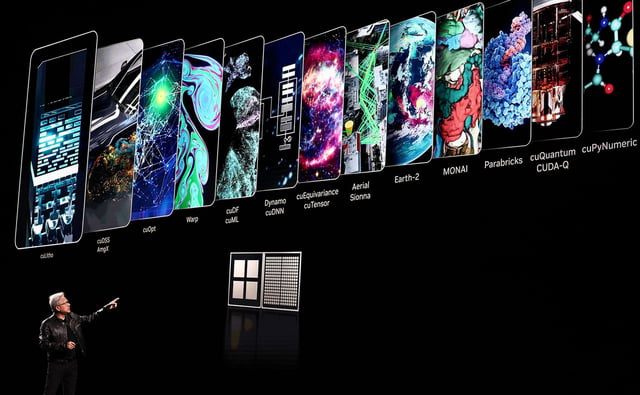

- Nvidia’s CUDA software ecosystem and upcoming Blackwell GPU architecture underpin its leadership even under U.S. export curbs to China