Overview

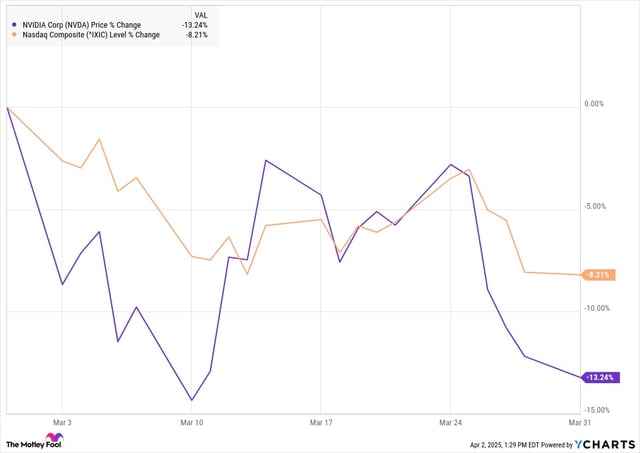

- Nvidia's stock is down 26% from its January 2025 peak, reflecting slowing growth and broader market pressures.

- HSBC downgraded Nvidia's stock from 'Buy' to 'Hold' and reduced its price target to $120, citing weakening GPU pricing power and limited near-term growth potential.

- President Trump's new tariffs have created uncertainty in the semiconductor market, though Nvidia's chips are exempt from these measures.

- Nvidia's recent product launches, including the Blackwell B300 GPUs, have not significantly boosted average selling prices, raising concerns about profitability.

- Analysts remain optimistic about Nvidia's long-term leadership in AI, with domestic manufacturing plans and innovation seen as key to future growth.