Overview

- Wall Street expects roughly $46 billion in quarterly revenue and about $1.01 in adjusted EPS, pointing to strong but slowing growth versus last year’s triple‑digit surge.

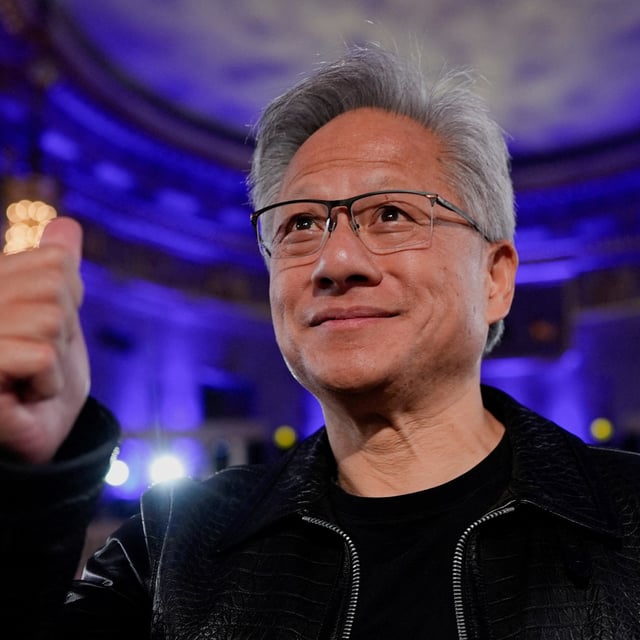

- Nvidia, now valued above $4 trillion, remains the dominant supplier of AI chips that power hyperscale data centers for Microsoft, Amazon, Alphabet and Meta.

- Massive outlays by major tech firms underpin demand, with more than $325 billion in AI investment budgeted this year across the largest buyers.

- The company’s China outlook is in focus after earlier export curbs produced multi‑billion‑dollar hits and a recent deal reportedly directed 15% of Chinese sales to the U.S. government.

- Investor nerves have been stoked by an MIT finding that 95% of AI pilots fail and by Sam Altman’s warning about a potential bubble, raising the stakes for Nvidia’s guidance and commentary.