Overview

- NS&I trimmed fixed rates on new two-, three- and five-year British Savings Bonds to 3.85%, 3.88% and 3.84% AER respectively, down from around 4%.

- The Junior ISA rate will fall from 4.00% to 3.55% AER on July 18, marking the first adjustment in nearly two years.

- One-year British Savings Bonds remain unchanged at 4.05% AER for both Growth and Income options.

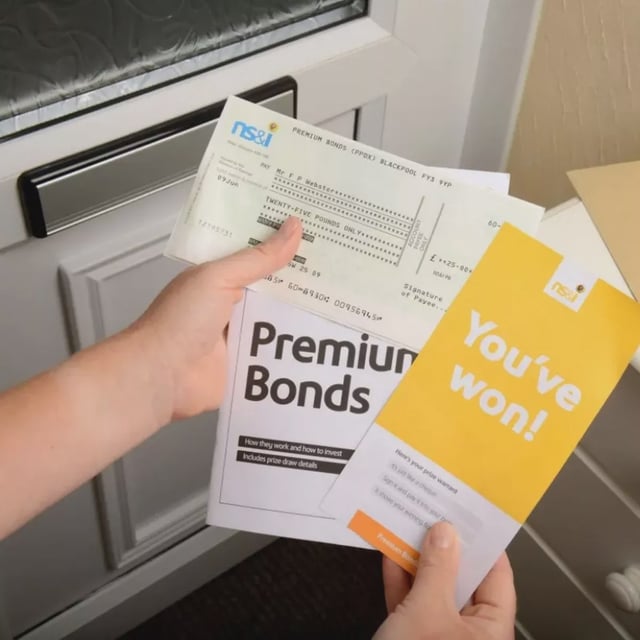

- The Premium Bonds prize fund rate will drop to 3.6% for the August draw, cutting the number of high-value tax-free prizes while keeping overall odds of winning steady.

- NS&I’s products stay fully Treasury-backed under its government funding mandate, but advisers warn further rate cuts may drive savers toward higher-yield ISAs and fixed-rate bonds.