Overview

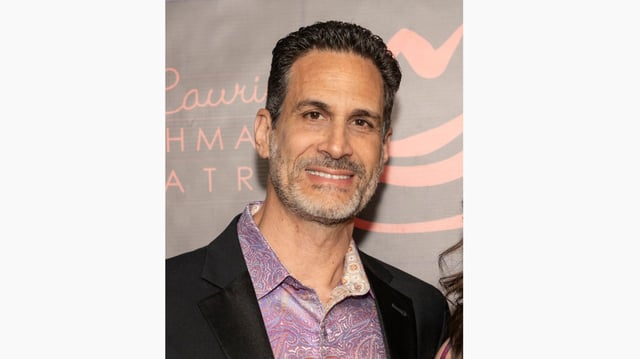

- Federal prosecutors charged Marco Giovanni Santarelli with one count of wire fraud over what they describe as a nationwide investment scheme tied to his Laguna Niguel firm.

- From June 2020 to June 2024, investors were solicited to buy unsecured notes of $25,000 to $500,000 that marketed roughly 12% to 15% monthly interest over three to seven years from ventures including real estate, e-commerce, Broadway shows, and cryptocurrency.

- Authorities allege balance sheets inflated assets and concealed more than $90 million in liabilities, and that new investor funds covered earlier payouts, leaving more than 500 investors with about $62.5 million in losses.

- Homeland Security Investigations and the FBI, assisted by the SEC, have seized over $5 million tied to the case and are continuing to trace additional assets.

- If convicted, Santarelli faces up to 20 years in federal prison; he declined to comment through an attorney as victims pursue separate civil claims.