Overview

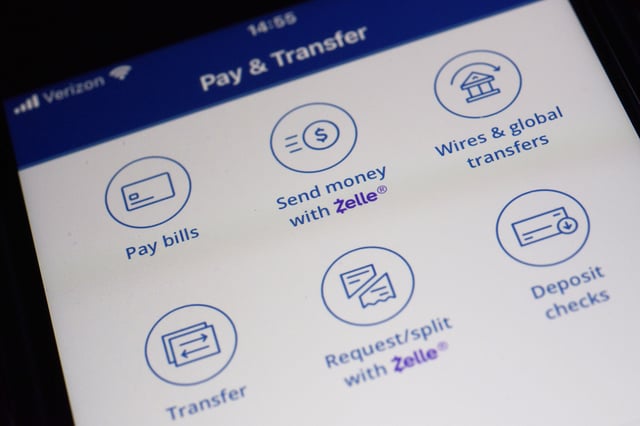

- In a suit filed August 13 in New York State Supreme Court, Letitia James accuses Early Warning Services of enabling over $1 billion in consumer losses between 2017 and 2023 through Zelle’s vulnerabilities.

- The complaint highlights Zelle’s quick registration, lack of identity checks and irreversible transfers as design flaws that scammers exploited to impersonate utilities, banks and sellers.

- New York claims EWS proposed anti-fraud measures in 2019 but did not broadly implement them until 2023 after CFPB scrutiny and congressional pressure.

- Following the CFPB’s dismissal of a related federal lawsuit in March, the state’s suit seeks restitution for victims, damages and court-ordered safeguards to strengthen Zelle’s fraud defenses.

- Early Warning Services, owned by seven major banks, calls the lawsuit a “political stunt” and cites a 99.95% transaction success rate without reported fraud.